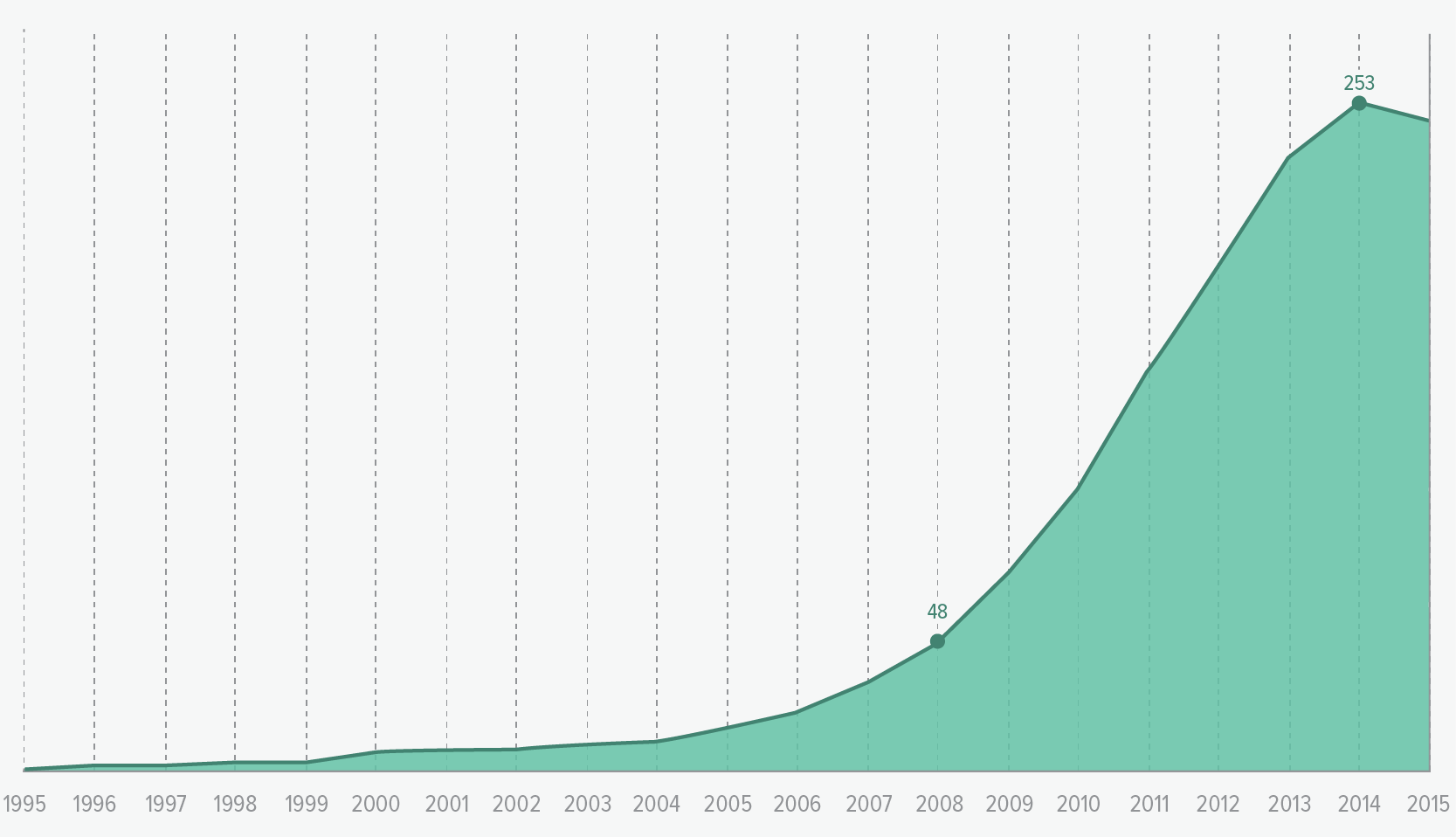

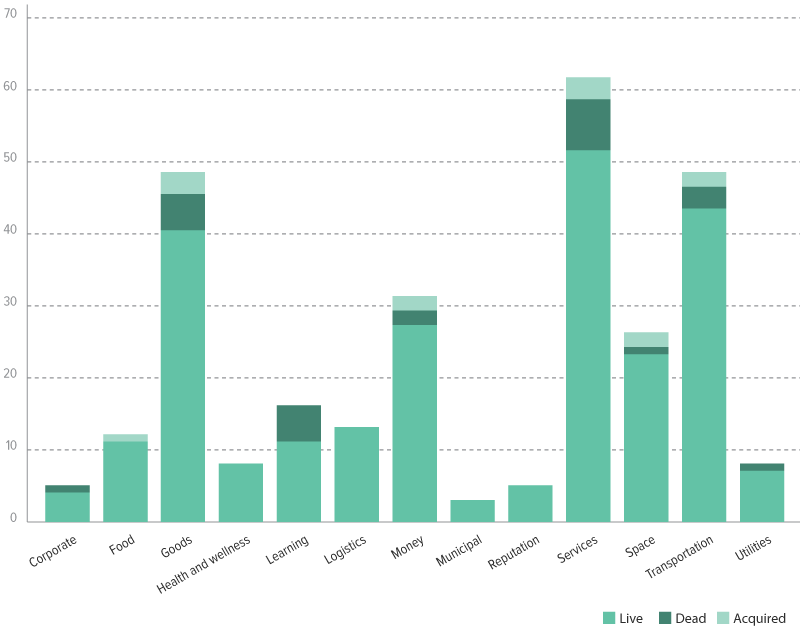

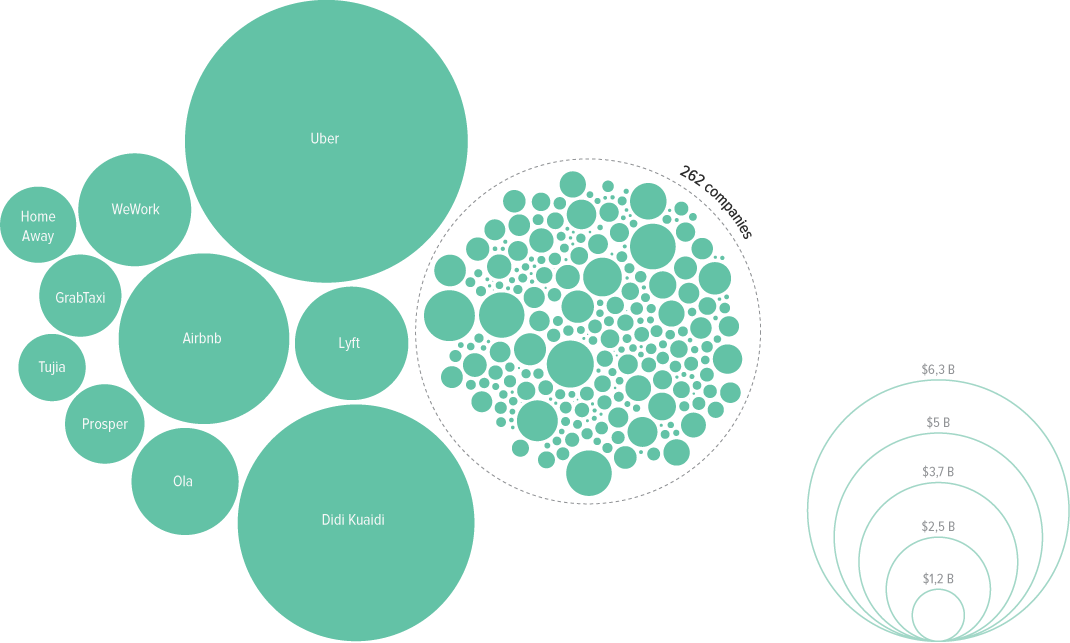

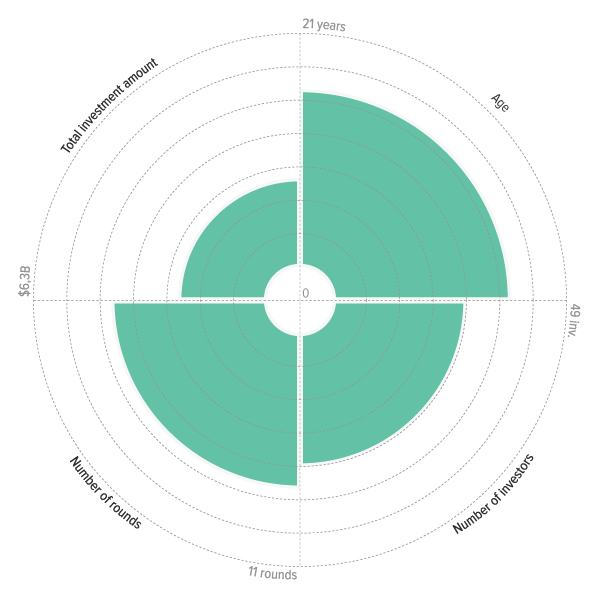

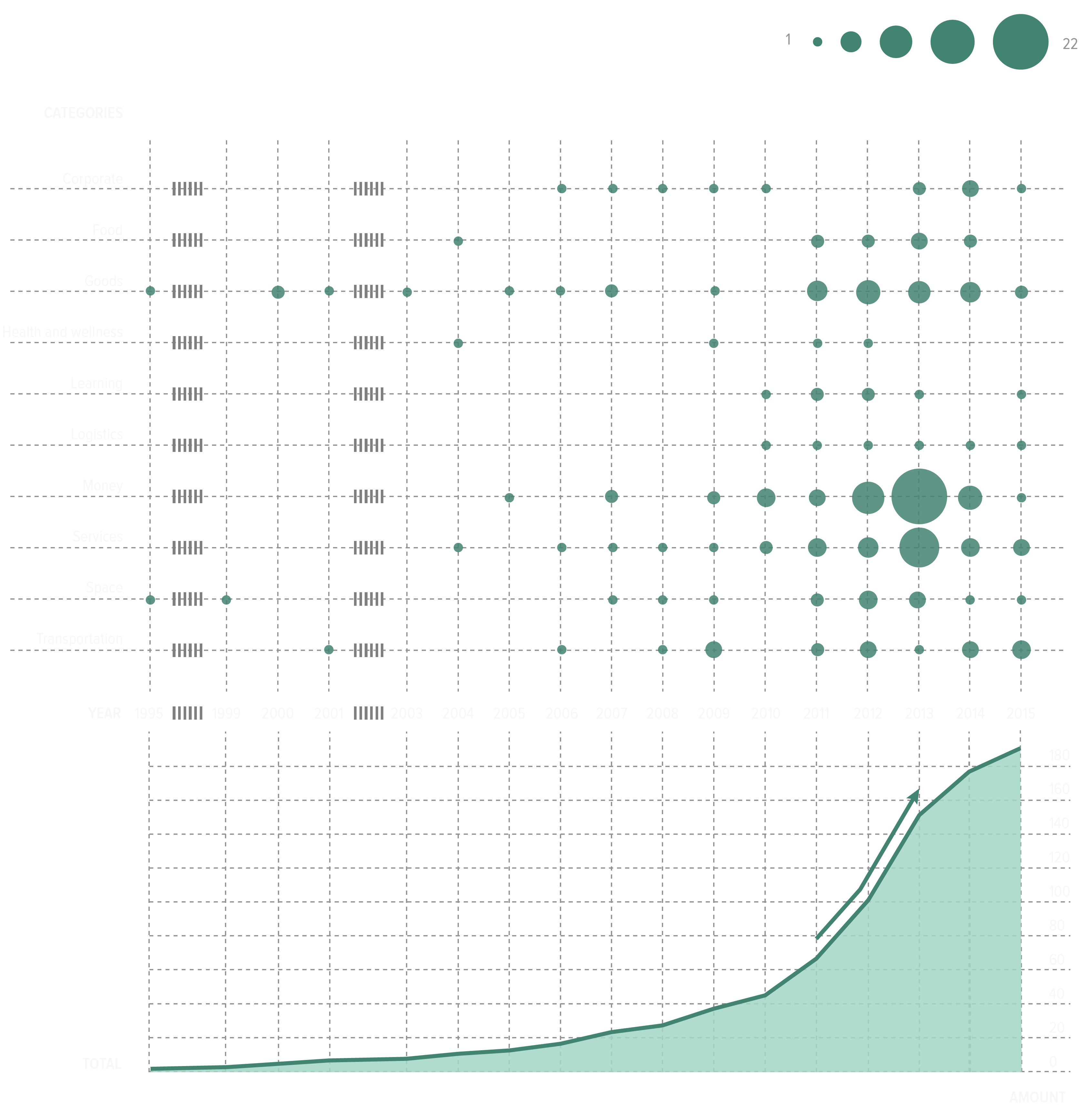

While 2014 was a huge growth year for individual sharing-economy companies, in 2015 the industry has seen the major growth as a whole. Collaboration is not only helping everyone to save and reuse underutilized assets, but it’s also involving the middle-high class.

2015: The Sharing Economy Is a New Norm

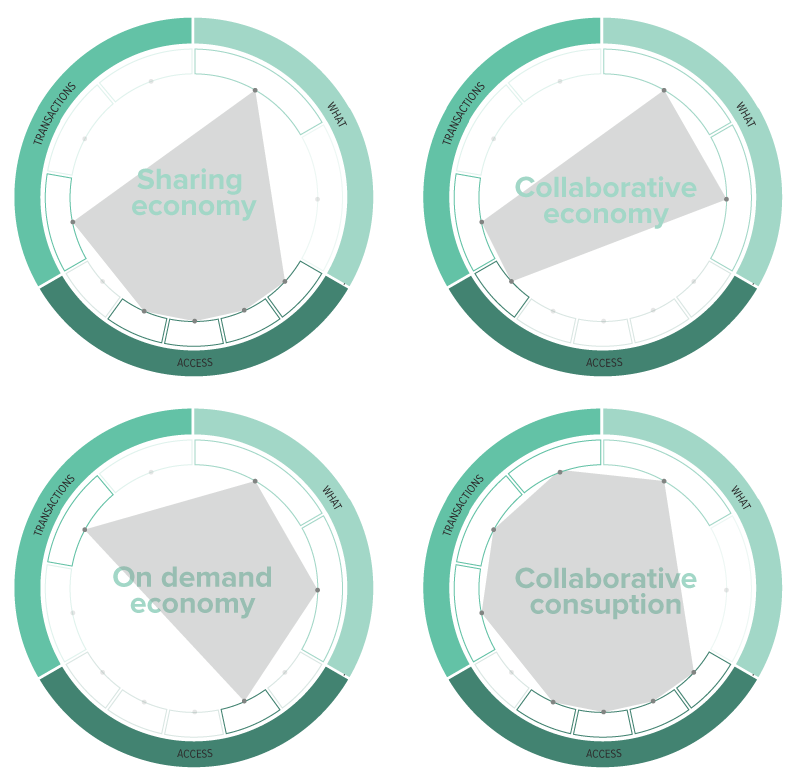

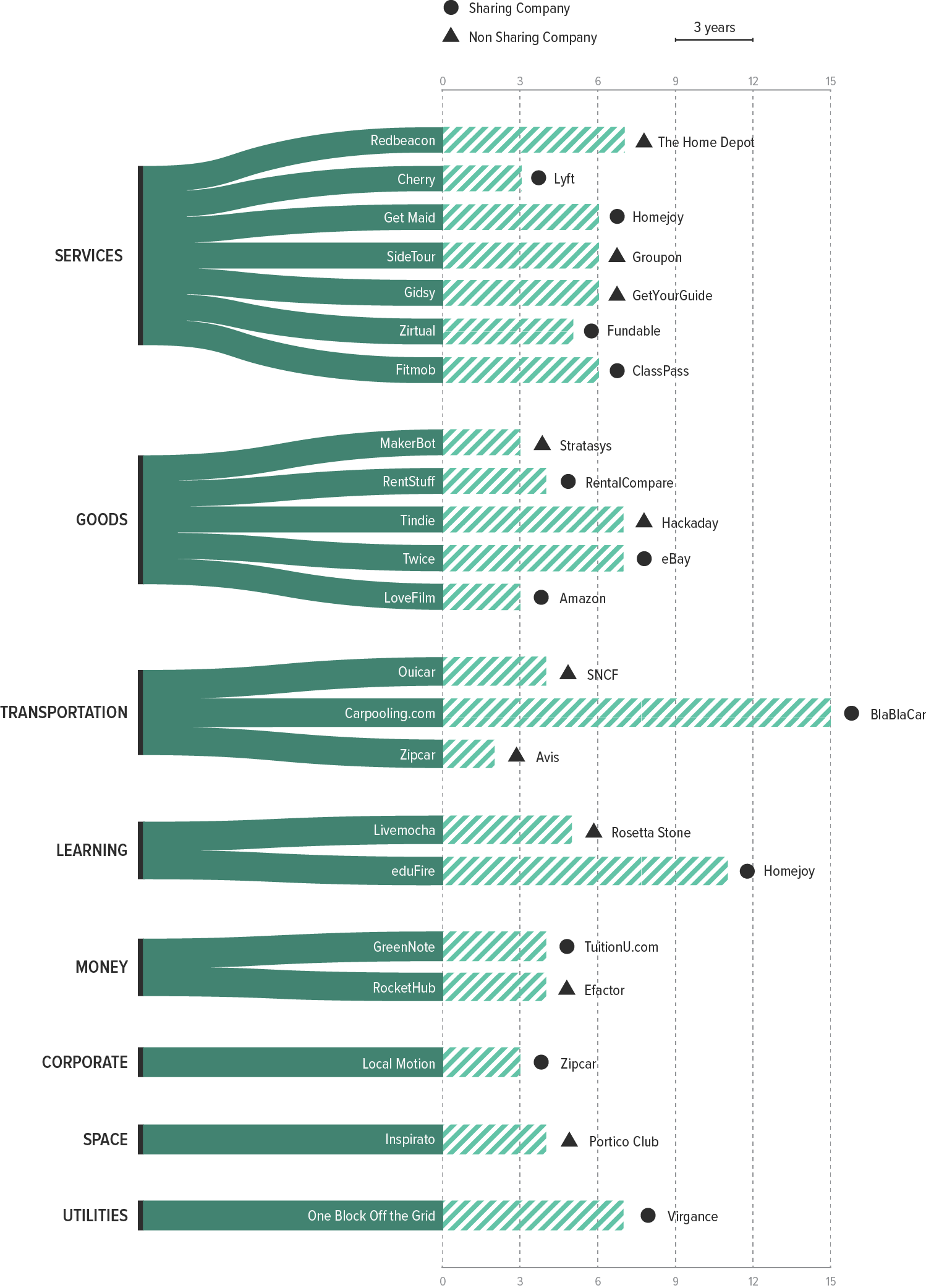

Because of this boom, the sharing economy is not yet fully defined. Its innovative and progressive character is still hurdles in a world sometimes conservative. The line between legality and illegality is still weak.

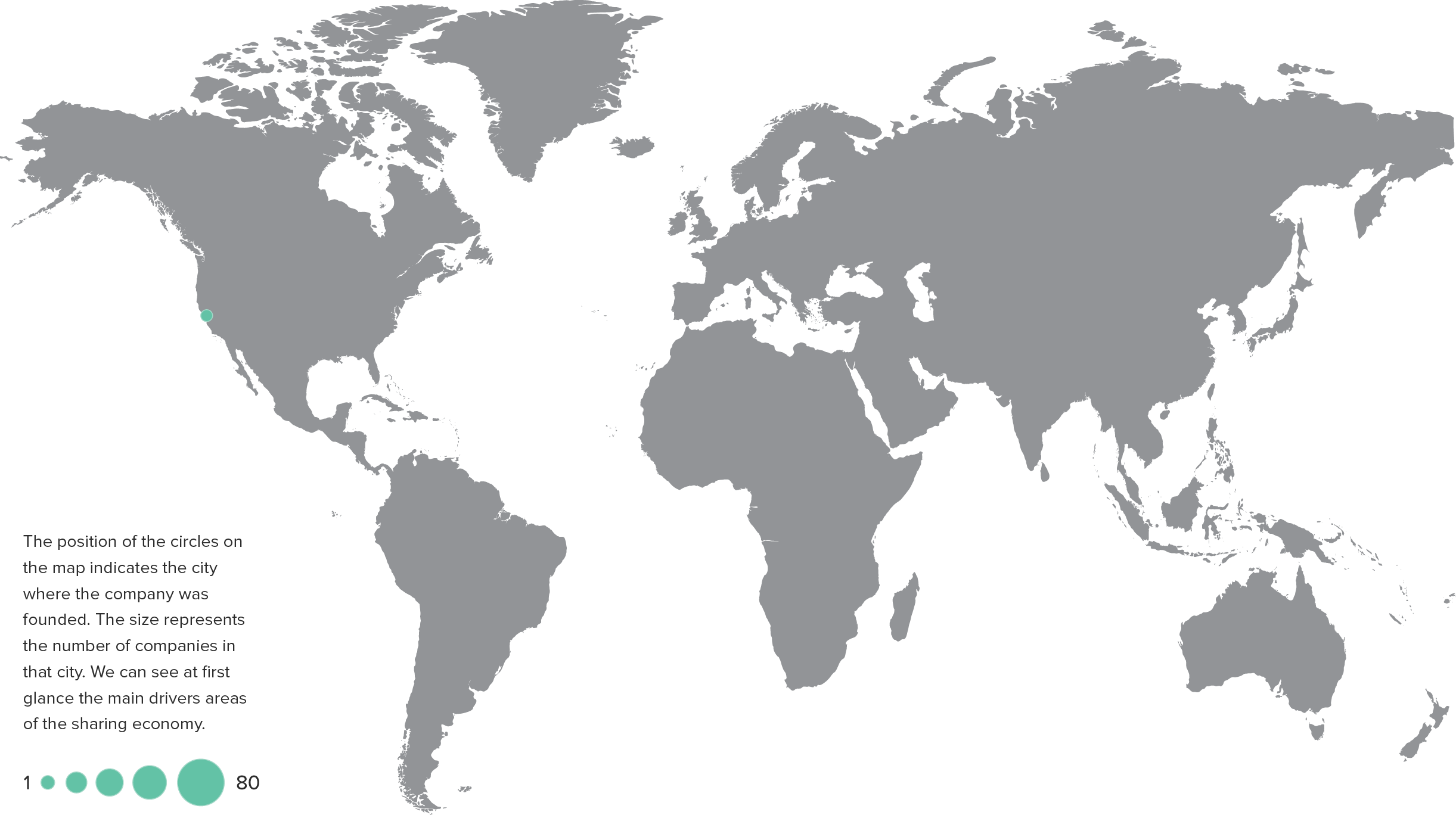

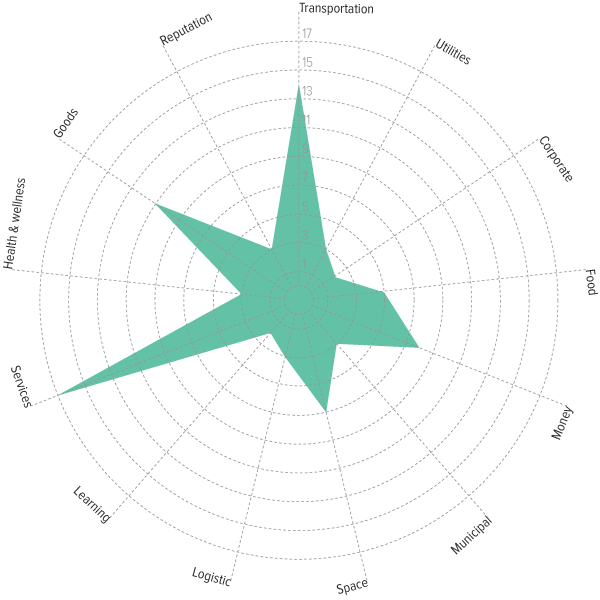

What's going on in the world? What and where is the role of the sharing economy?