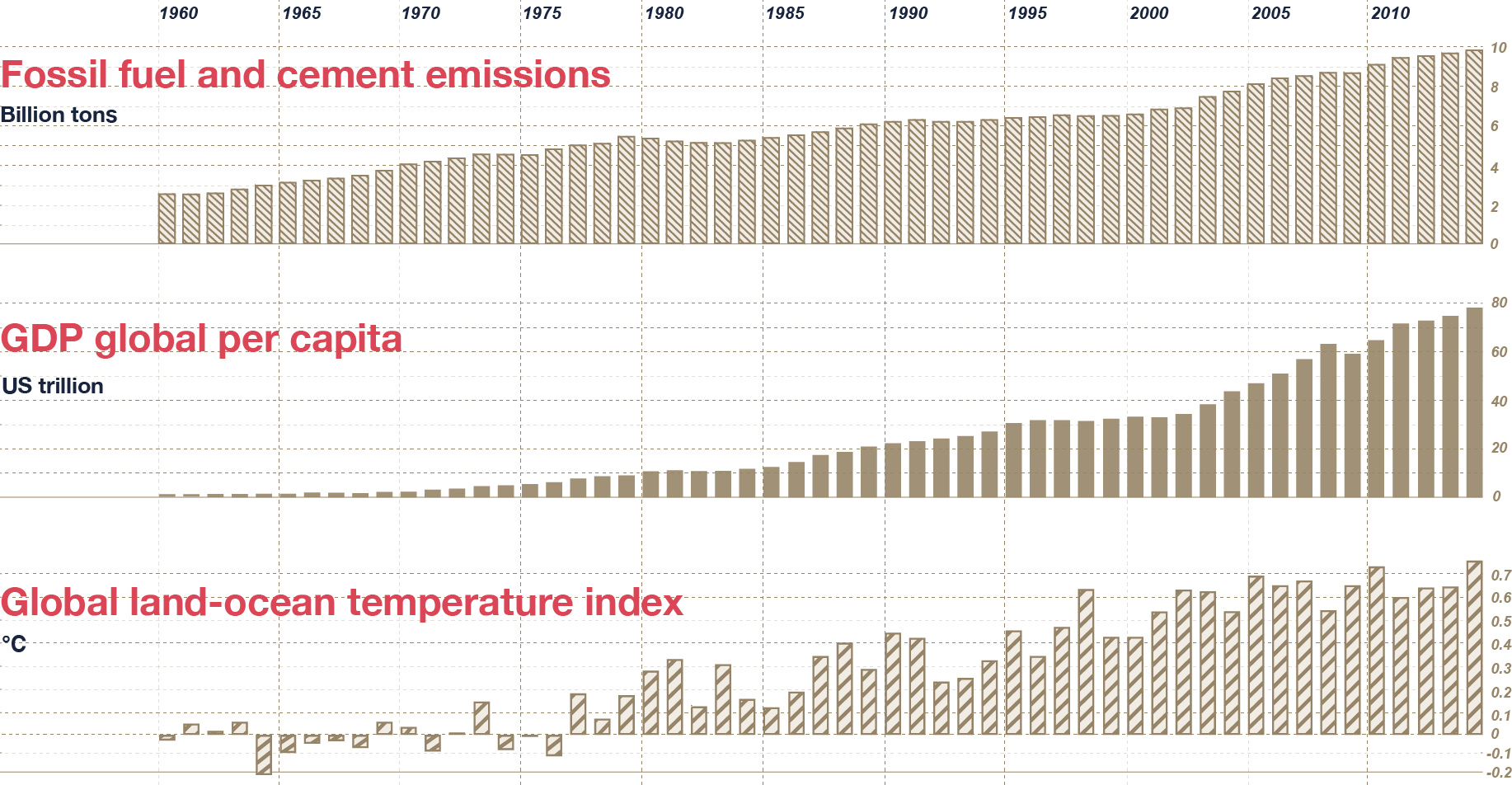

THE POTENTIAL

RELATIONSHIP BEHIND

We have already concluded that most of the observed warming is due to the burning Fossil fuels. Fossil fuels such as oil, coal and natural gas are high in carbon and, when burned, produce major amounts of carbon dioxide or CO2. This conclusion is based on understanding of the atmospheric greenhouse effect and how human activities have been tweaking it from the Industrial Revolution. The chart show the relationship between GDP global per capita, CO2 emission and Tempreture global.

data source:World Bank